Block trading functionality has become an integral part of the South African liquidity landscape, for the very reason that it allows participants to arrange and transact orders of significant size in equities and other equity-like instruments with minimum exposure and market impact. In 2023, the value of block trade executions stood at approximately R243 billion. Although this amount may seem insignificant relative to overall market activity (~5%), it has grown from R52 billion just 7 years ago. To further examine this growth trend, let us look at the developments around block trade rules, users, and their market impact.

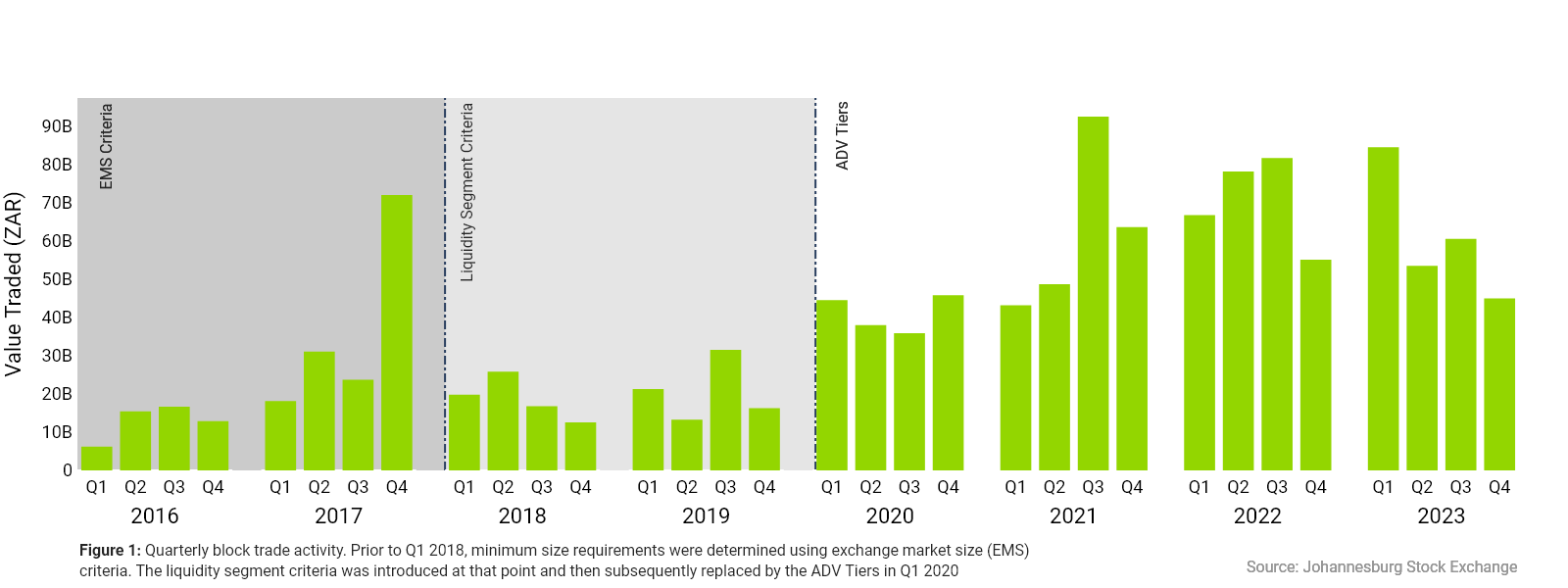

The JSE’s block trades are pre-negotiated transactions that are executed away from the central limit order book, as they are reported to the exchange, on the basis that the transactions meet specified quantity thresholds. Over the years these size requirements have taken different forms, starting with concept of Exchange Market Size (EMS), which prescribed the minimum size as a function of the instrument’s liquidity segment and a multiple of a quantum specified by the market controller. The EMS criteria was later substituted in 2018 by a methodology that determined the block size as a fraction of the instrument’s average daily value traded (ADV). This change effectively amounted to a reduction in block size requirements, however it did not adequately address the challenges with heterogeneity of instruments within the liquidity segments. The most recent change happened in 2020, which introduced ADV tiers that may be likened to the MiFID II Large-in-Scale criteria. Figure 1 shows that subsequent to the introduction of ADV tiers, the total value of executed block trades increased significantly.

Most block trading is by large members.

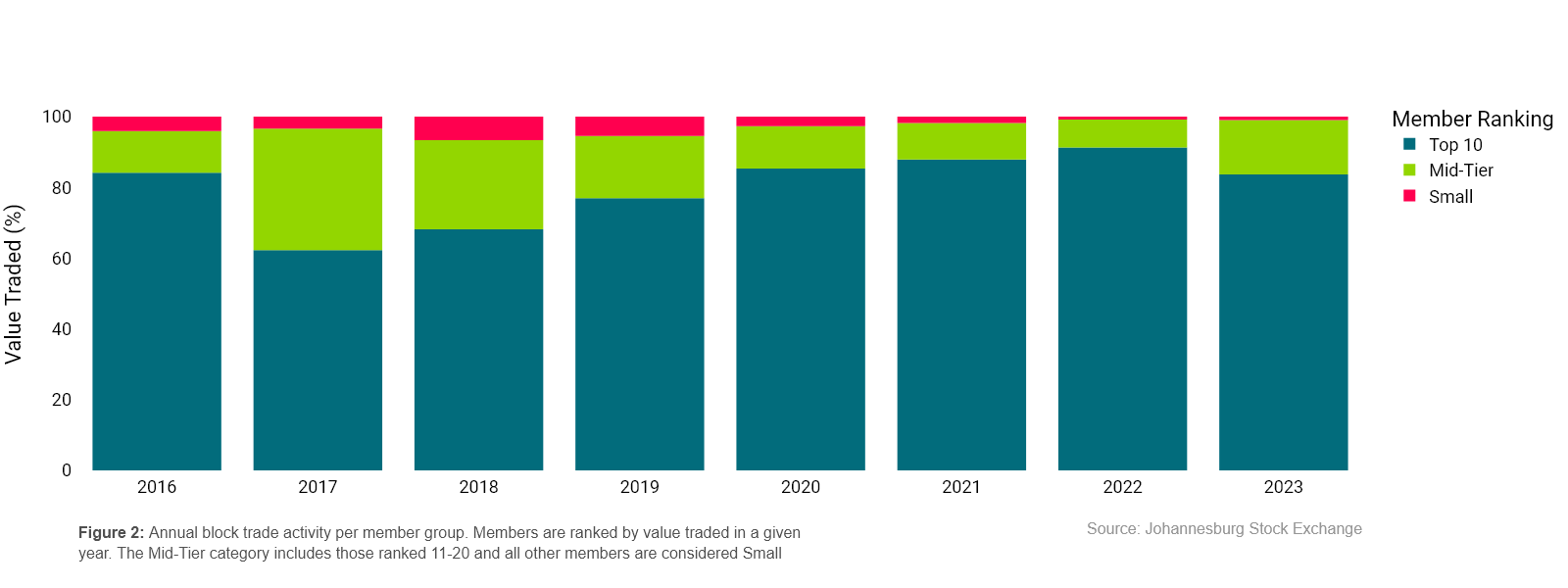

Figure 2 shows that historically, the largest users of blocks trades have been the ten largest members in the local equity market. This comes as no surprise when one unpacks the nature of the business of block trades. First, consider that execution prices are negotiated and agreed upon away from the central limit order book, making this an inherently high touch business. Any member that has and can leverage their relationships with large institutional clients will execute relatively more flow. Second there is no regulatory requirement for the transaction to be bilateral, between two different members of the exchange. Inevitably, where a member can, they will first look to cross internally to maximize fees. In fact, available data indicates that on average only 8% of the annual executed value in block trades has been bilateral.

Trading in the concentrating in the middle tiers

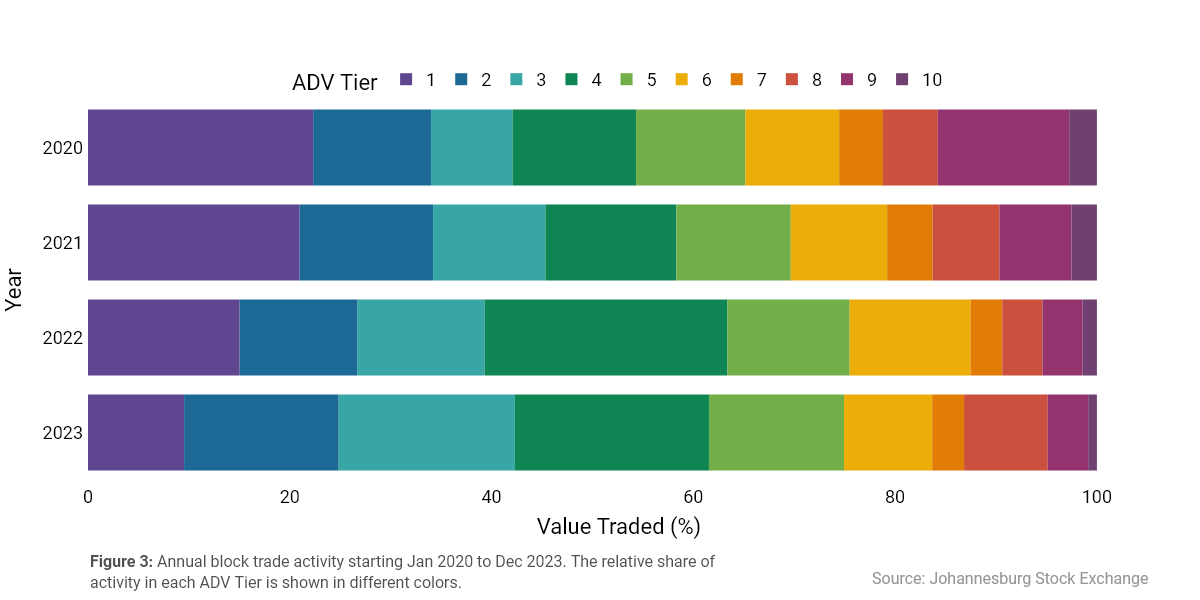

Figure 1 showed us that, since the introduction of the ADV tiers in 2020, the use of block trades has steadily been increasing. What is not so salient from that information is what has been driving that increase in activity. Figure 3 below shows the annual activity for each of the ADV tiers.

We can see that over the years, block trading has started to concentrate in the middle tiers. The relative share of Tier 1 instruments, with a minimum size of R30m, has declined from 22% in 2020 to 10% in 2023. Similarly, Tier 9 and 10 instruments, with a minimum size of R1m, accounted for 16% collectively in 2020, down to 5% in 2023. In contrast, Tiers 3, 4 and 5 have increased from 8%, 12% and 11% in 2020 to 18%, 19% and 13%, respectively in 2023.

Market impact

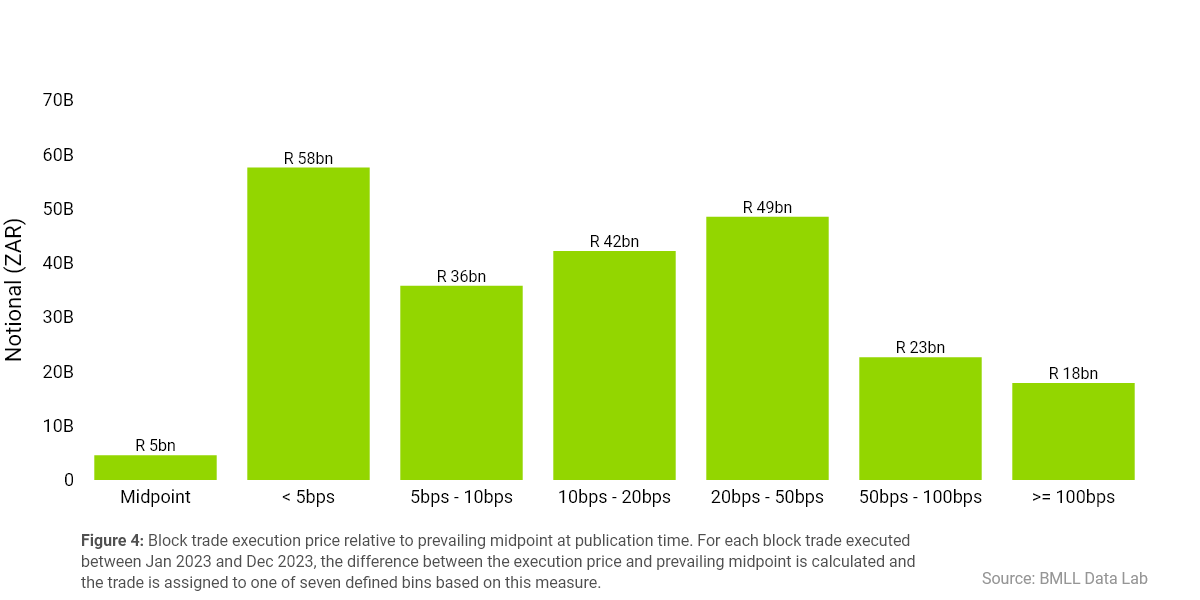

An important feature of block trades is that there are no reference price requirements. Execution prices are pre-negotiated, and restrictions are placed only on the execution sizes, as defined by the ADV tiers. Data shows that in 2023, only 2% of the notional value executed using block trades was executed at a price equal to the prevailing midpoint at the time of the trade’s publication. Moreover, 25% (R58bn) executed at a price less than 5bps away from the midpoint at the time of publication and 8% more than 100bps away.

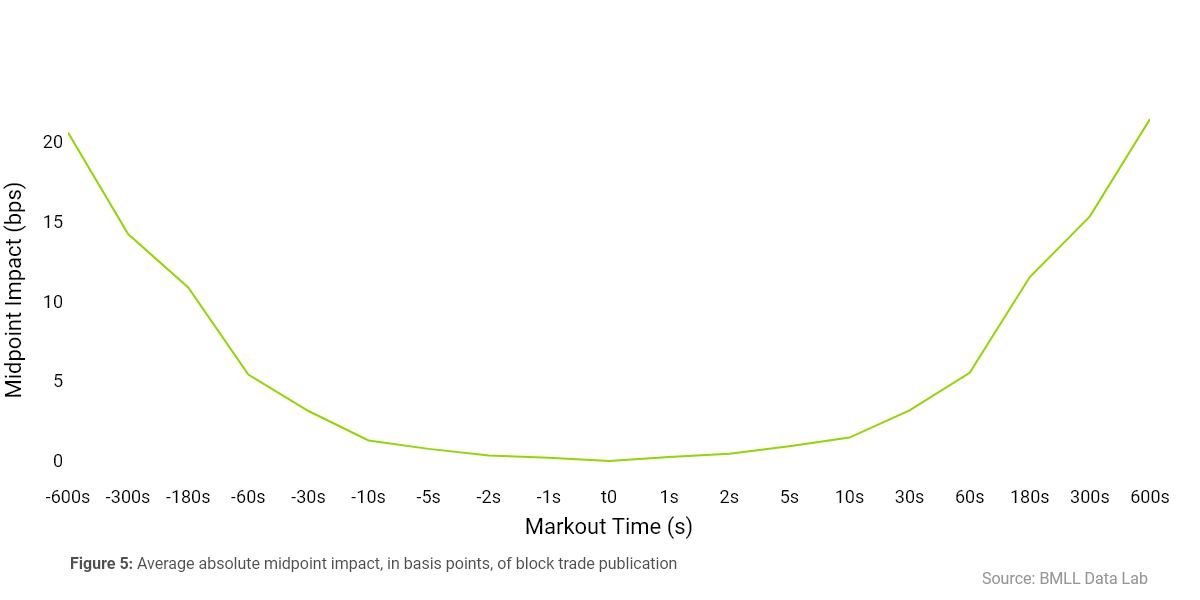

The information presented in Figure 4 inevitably begs the question whether the publication of block trades has any impact on prevailing prices in the central limit order book. To answer that question, Figure 5 looks at the midpoint impact of the publication of a block trade at discrete time intervals. Interesting points to note here are that block trades do not appear to have an immediate significant impact on the prevailing midpoint, and the shape of the chart is relatively symmetrical.

On average, the midpoint impact only exceeds 1bps five seconds after the publication timestamp and reaches 5.5bps at the one-minute interval. This result is unsurprising, given that (i) block trades are generally not included in volume-weighted-average-price (VWAP) calculations, and therefore have no impact on execution algorithms, and (ii) increasing the markout time increases the likelihood that events exogenous to our analysis have also had an impact on the midpoint, given the high frequency nature of modern markets. There is therefore insufficient evidence to support the argument that the absence of pre-trade transparency, in this instance, has an impact on prevailing prices. Nevertheless, to allay any concerns participants may have, the JSE offers additional reporting functionality that allows the publication of a block trade to be delayed by up to two hours. However, the data also indicates that this functionality has not been used to date.

In summary, it is clear from the above information that block trades continue to grow as the market’s preferred method to execute large quantities. Block trade usage increased significantly following the introduction of ADV tiers and this growth has largely been driven by activity in the middle tiers with minimum execution sizes between R7m and R15m. Lastly, the evidence indicates that the publication of block trades has no significant impact on the prevailing midpoint in the central limit order book.

More information about the block trade functionality is available here.