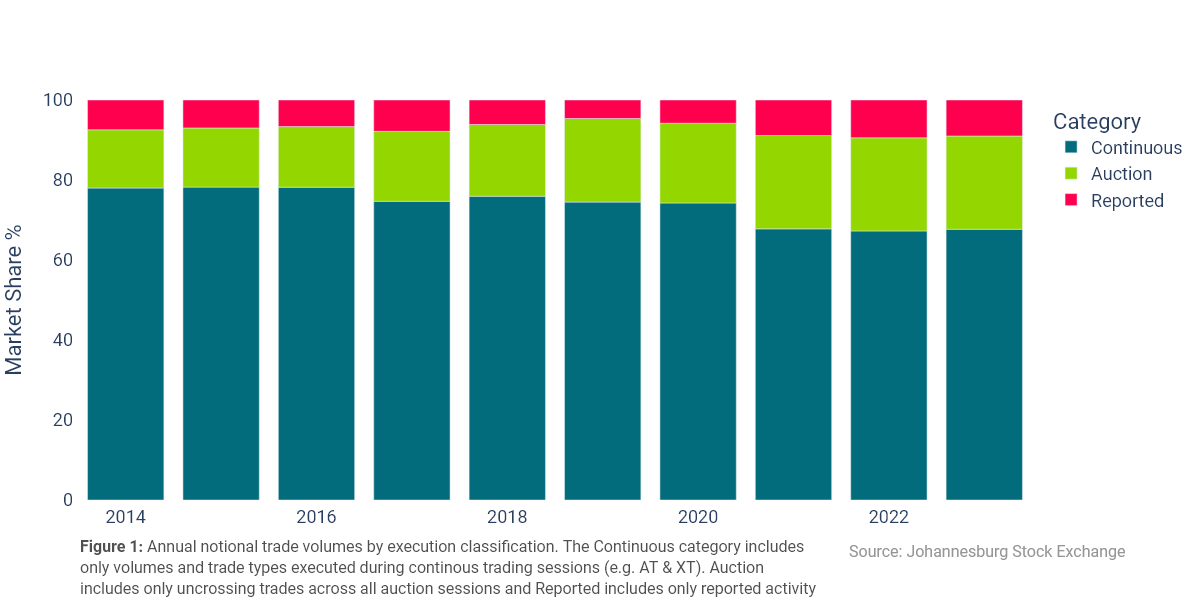

Auctions can be understood to be ‘liquidity events’ where all trading interests submitted during a specified interval are aggregated and matched at a single price that maximizes the volume of trade. On a typical trading day there are three such events at the JSE – the Opening Auction, that takes place between 8:30am and 9am, the Intraday Auction between12pm and 12:15pm, and the Closing Auction that wraps up the trading day, from (4:50pm till-5pm). 10 years ago, the value traded during the JSE’s auction sessions accounted for approximately 15% of all value traded at the exchange. Today, this share of activity is almost 1.5times what it was in 2014 at 25%. This growth in auction activity can be attributed solely to the closing auction, which accounts for, on average, 99% of all the JSE’s auction activity.

Evolution of closing auction activity

Over the recent years, the significance of closing auctions as a daily liquidity event has increased to varying degrees across global financial markets. What sets this trading session apart from all other auction sessions is that it establishes an essential industry performance and valuation benchmark – the official closing price. This, in addition to the following factors can for the most part explain the shift toward trading at the close:

- An increase in capital flows to passive managers and passive investment products; Precise tracking of indices and exchange traded products (e.g. ETFs) by funds, requires trading at the benchmark price in order to minimize tracking errors.

- The risk of adverse selection associated with information asymmetry; By trading at the close, where all order flow can only be matched and traded at a single market-clearing price, the cost of adverse selection from executing against a participant with more information is minimized.

- As liquidity has accumulated in the closing auction, it has become an attractive place for many to execute size with minimal price impact. Coupled with the widespread use of VWAP algorithms that adapt execution volumes to replicate the broader market, trading at the close has lent itself to the self-reinforcing nature of liquidity.

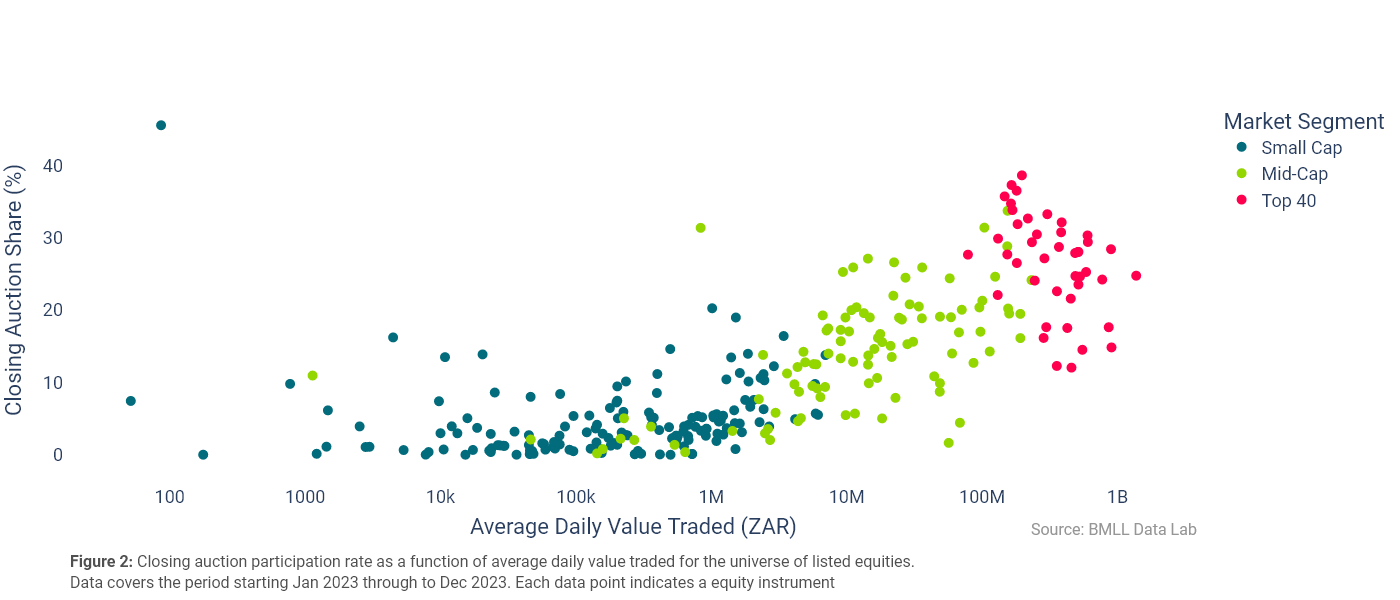

Higher Closing Auction Participation for most liquid equities

All JSE listed stocks can be categorized into one of three segments: ZA01 (Liquid, Top 40), ZA02 (Medium Liquid, Mid-Caps) and ZA03 (less Liquid, Small Caps). The figure below shows, for the entire universe of listed stocks, the closing auction participation rate - closing auction volume as a percentage of total volume - as a function of the stock’s average daily value traded. It is evident that closing auction participation is generally higher for more liquid stocks. This result is unsurprising as it is consistent with the weightings used in the indices and exchange traded products associated with the passive strategies. What is interesting to note is the significantly different variation in closing auction participation across market segments. In the most liquid segment (Top 40), the measure is relatively consistent within the group ranging between 12% and 38%. In contrast, the Small Caps segment has a much wider range of observations starting at 3% to 93%.

Rebalance dates matter

Rebalance events are essential trading for any passive participants looking to minimize tracking errors. The deep liquidity often associated with these events also presents an opportune moment for those participants looking to execute size, regardless of whether they are tied to the closing price benchmark. Figure 3 plots the daily market share of the closing auction against the total value traded in that day. As expected, volumes gravitate to the close on index rebalance dates. In contrast, closing auction market share on the days on which quarterly equity derivatives expire is typically lower than on most days. This result is not entirely surprising, as on these days an intraday auction takes place to determine the prices at which the derivatives contracts will expire, and this is the session in which liquidity concentrates. Lastly, the data also indicates that the market share of closing auctions is generally higher on month-end days than on every other non-event day.

Summary

- The shift from active to passive investing in ETFs and other exchange traded products has been a key driver of the increase in closing auction participation.

- The market share of the closing auction tends to be higher for more liquid stocks. This is consistent with the liquidity profile of the exchange as a whole.

- Absolute volumes and the market share of closing auctions tend to be greater on rebalance dates and month ends. FTSE/JSE rebalance events have the greatest effect.

- Liquidity begets liquidity. The growth in closing auction activity has amplified the session’s critical role as a unique liquidity event for robust price discovery.