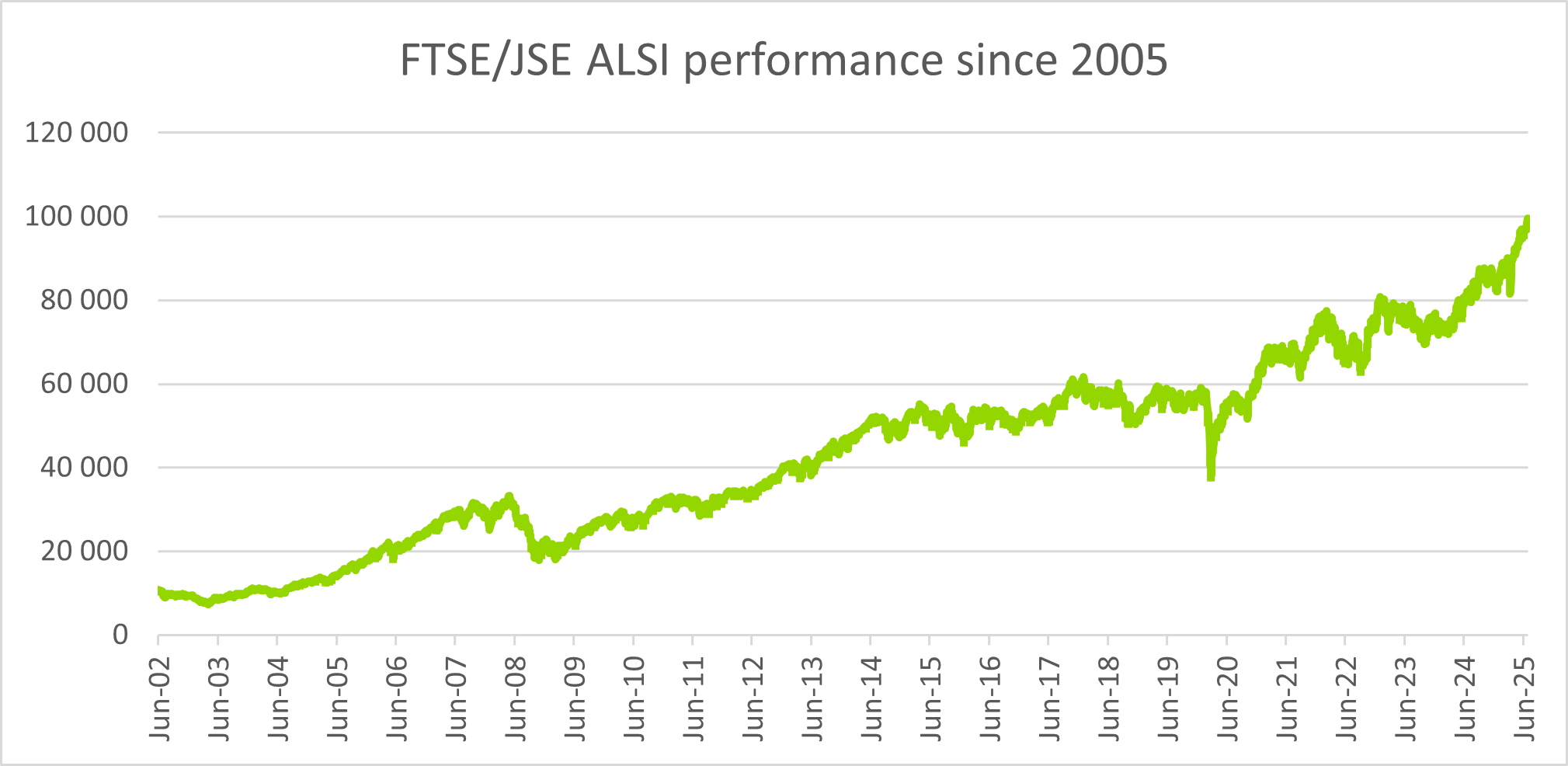

Johannesburg, 23 July 2025 – Over its 65-year journey, the ALSI has delivered annualised returns of over 11%, reflecting the resilience and growth of South Africa’s capital markets. 2025 has positioned the JSE among the best performing markets in the world in Dollar and Rand terms.

“Reaching 100,000 points on the ALSI is not just a numerical milestone – it is a powerful reflection of the resilience, innovation and operational excellence of companies listed on the JSE. This landmark demonstrates that investors continue to place their trust in the South African market and in the ability of our listed companies to drive growth and deliver value. As the JSE, we are proud to provide a platform that enables capital raising, fuels economic expansion and creates opportunities for wealth creation across society,” says Leila Fourie, Group CEO of the JSE.

Mark Randall, Director of Information Services further elaborates, “Redefined in 2002 through a strategic partnership with global index provider FTSE, the FTSE/JSE ALSI adopted modern methodologies including free float weighting and a fixed universe of 160 companies. Today, the index represents 125 listed companies on the JSE with a combined market capitalisation of R21 trillion, spanning a diverse range of sectors and geographies. While the ALSI does not include every listed company, it remains a trusted benchmark, capturing 99% of the eligible market capitalisation on the JSE Main Board. It distils the daily performance of large, mid, and small-cap stocks into a single, accessible figure visible across media platforms and financial tickers, underscoring the strength of South Africa’s equity market and the JSE’s role as a gateway to African investment.”

The ALSI has delivered robust long-term growth since 2002, overcoming global crises and commodity swings to reach a historic 100,000 points in 2025. The past five years (2020–2025) were particularly dynamic, with the index rebounding strongly from pandemic lows, driven by commodity booms (gold, platinum), resilient corporate earnings and improved investor sentiment. Key sectors like mining, banking and technology fueled gains, while structural reforms and fiscal stability underpinned the JSE’s rise as a gateway to African markets. This feat reflects both the index’s resilience and its role as a barometer of South Africa’s economic potential.

“We remain committed to advancing market development, improving access to capital for businesses of all sizes and ensuring that our exchange continues to evolve in line with international standards. This milestone is a reminder of the important role the JSE plays in enabling companies to grow, innovate and create jobs, which ultimately benefits the broader economy,” concludes Fourie.

The JSE reiterates its dedication to providing a transparent, efficient and secure platform for issuers and investors alike, further cementing its position as the gateway to African capital markets.

ENDS

ABOUT THE JSE

The Johannesburg Stock Exchange (JSE) has a well-established history of operating as a marketplace for trading financial products. It is a pioneering, globally connected exchange group that enables inclusive economic growth through trusted, world-class, socially responsible products, and services for the investor of the future. It offers secure and efficient primary and secondary capital markets across a diverse range of securities, spanning equities, derivatives, and debt markets. It prides itself on being the market of choice for local and international investors looking to gain exposure to leading capital markets on the African continent.

The JSE is currently ranked in the Top 20 largest stock exchanges in the world by market capitalisation, and is the largest stock exchange in Africa, having been in operation for 137 years. As a leading global exchange, the JSE co-creates, unlocks value and makes real connections happen. www.jse.co.za

The JSE takes your privacy seriously in accordance with the POPI Act. We endeavour to only send you relevant information that we think will be of interest to you and the media title you work at. No action is required if you are happy to continue receiving JSE news and information. Should you change your mind at any time in the future, please do let us know. If you do not wish to receive JSE news and information, please respond to this email and we will remove you from future distributions.

JSE general enquiries: Email: [email protected] Tel: 011 520 7000 | JSE media contact: Paballo Makhetha Communication Specialist Tel: 011 520 7331 | Mobile: 066 261 7405 Email: [email protected] |